The market has been in a historically narrow range since February from S&P500 2040 to a high of about 2130. It is interesting to see the level of volatility from time to time even as the market is basically flat for the year. We have not had a 5% drawdown from the top all year. If this continues, it would only be the second time in 50 years that the market has gone the entire year without a correction of at least 5%.

We believe this years action is partly a consolidation of the gains over the last couple of years. With recent double digit returns and a 30% plus move in 2013, a time of pause should not be unexpected. It is positive that we have been able to go through this longer term consolidation phase without a more volatile correction.

Uncertainty: The market does not like uncertainty and we have had our fair share; Russia, Greece, Iran, NYSE glitches, Syria, Puerto Rico not to mention China. We also have the certainty that the Fed will raise rates but still, the uncertainty as to when. The rate hike should not have much impact as it is the most telegraphed rate hike in history. Considering these concerns and that we have had to deal with many of them simultaneously, one might argue that the market has held up quite well.

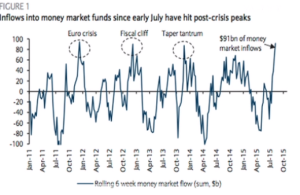

During times of uncertainty, money often moves to the sidelines. As the chart below indicates, inflows to money market funds has accerated recently. In the past, this has been a buying opportunity while facing other times of uncertainty like the Fiscal Cliff or last year’s Taper Tantrum.

Yes, it may be uncomfortable for a while and there will be days like today. But, we remain bullish intermediate and longer term. The American economy has been in a very slow recovery but, a recovery nonetheless. Most economic indicators point to further improvement including housing, housing prices and unemployment.

We may have more volatility near term but, we expect the market higher by year end. Avoid emotional decisions and….stay tuned.